NEWS

- 2022.11.30

- PRESS RELEASE

JTOWER decided to enter into the financing contract for telecommunications tower carve outs from NTT DOCOMO Total amount of financing is approx. 107.4 billion yen/ Accelerate the tower transfer

We are pleased to announce that JTOWER Inc. (“JTOWER”) decided to enter into the financing contract (“the financing contract”) to raise the funds required for the project to acquire telecommunications towers from NTT DOCOMO, Inc. (“DOCOMO”) (“the project”).

In March 2022, JTOWER entered into the master transaction agreement which enables JTOWER to acquire up to 6,002 telecommunications towers owned by DOCOMO and DOCOMO to lease these towers from JTOWER. After the conclusion of the financing contract, JTOWER will accelerate the tower transfer from DOCOMO and promote utilization of these towers for Infra-Sharing. By promoting Infra-Sharing, we will provide cost effective investment and operational solution for mobile network operators and the early development of 5G.

Infra-Sharing of acquired towers leads to the effective use of existing infrastructures and we believe it becomes an effective measure to reduce environmental impact.

■Outline of the financing

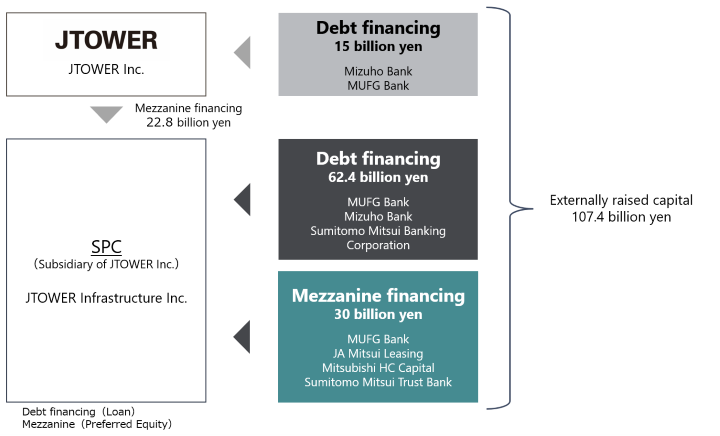

The total amount of the financing is approximately 107.4 billion yen and the majority of the financing consists of loans from multiple financial institutions (debt financing: 3 companies *1) and preferred equity investors (mezzanine financing: 4 companies *2). Both financings are for the purpose of raising funds in JTOWER Infrastructure Inc., the SPC (special-purpose company) established in April 2022 as a subsidiary of JTOWER (*3)

In the process of making decisions on the financing, some financial institutions have evaluated the contribution to the achievement of SDGs through the promotion of Infra-Sharing.

*1: MUFG Bank, Ltd., Mizuho Bank, Ltd. and Sumitomo Mitsui Banking Corporation

*2: MUFG Bank, Ltd., JA Mitsui Leasing, Ltd., Mitsubishi HC Capital Inc. and Sumitomo Mitsui Trust Bank

*3: Mizuho Securities Co., Ltd. is employed as a financial advisor for the financing in SPC

*4: Mizuho Bank, Ltd. and MUFG Bank, Ltd.

■Future Outlook – Accelerate the tower transfer and expand co-tenancy

After the conclusion of the financing contract, JTOWER will start the transfer from the tower where the condition has been met and will accelerate the attraction of new tenant, including other mobile network operators.

In addition to the tower acquisition from mobile network operators, JTOWER will also promote the construction of new towers for Infra-Sharing in rural and suburban areas.

Under the corporate vision of “Infra-Sharing Services from Japan Lead the World,” JTOWER will contribute to both the development of efficient network infrastructure such as 5G and the realization of a sustainable society through the tower sharing.

【Structure of financing】

【Outline of JTOWER Infrastructure Inc.】

(1)Name

JTOWER Infrastructure Inc.

(2)Head office address

2-2-3, Minamiaoyama, Minato-ku, Tokyo

(3)Name and role of representative

The representative partner:

JTOWER Infrastructure Holdings Inc.(The subsidiary of JTOWER)

Executive officer Atsushi Tanaka

(4)Business Profile

Telecommunications Infra-Sharing business

(5)Capital

0.1 million yen

(6)Date Established

April 18, 2022

(7)Major shareholders and their shareholding ratio

JTOWER Infrastructure Holdings Inc. 100%