This column covers tower carve-out. In other word “carve-out = cutting out”. In the business, there is a way to increase the business value by cutting out a portion of business and establishing it as an independent entity.

Then, what is carve-out in Infra-Sharing?

Create new asset value and restructuring as new business

I see carve-out has a potential to be a game changer in the mobile phone industry.

But before that, let’s look at the situation of carve-outs in the telecommunications industry both in Japan and overseas markets.

In March 2022, NTT DOCOMO announced the transfer of up to 6,002 telecommunications towers to JTOWER and the news became a hot topic in the telecommunications industry.

In addition to NTT DOCOMO, JTOWER concluded master transaction agreements to purchase existing towers from NTT East and NTT West. (As of October 31, 2023)

- NTT DOCOMO:7,554 towers

- NTT East:136 towers

- NTT West:71 towers

Especially for the towers acquired from NTT DOCOMO are

This was the first deal in Japan in which MNO sold a substantial number of towers that would be used in the future to sharing provider.

In JTOWER, we will attract new tenant to the towers we purchased and conduct business that creates new value as tower sharing.

So, in summary, the carve-out in Infra-Sharing means that the existing tower assets will be operated by a new sharing provider to create new asset values and restructure them as new businesses.

From now, I will explain why carve-out can be a game changer.

Perspectives of buyer, seller, and user

Until now, Japanese MNO have dominated the construction of telecommunications infrastructure, giving them a competitive edge and differentiating them from other operators.

Then, why did NTT DOCOMO decide to sell the tower assets, one of the elements of their competitiveness? I will examine the implications of this from three different perspectives: the buyer, the seller, and the users. What are the benefits of each of them?

Seller: MNO

In Japan, competition among 3 MNO has matured and the network coverage is no longer a differentiating factor. Against this backdrop, carve-out is expected as a purpose to improve financial indicators that are valued by stock-market, such as ROIC*.

*ROIC(Return On Invested Capital):

An indicator that shows how much profit is being generated against invested capital.

By selling towers, it is possible to off-balance the asset and improve capital efficiency.

For reference, this is extract of NTT Annual Report 2022.

Capital allocation (page 22)

We are also working to secure cash and improve capital efficiency while reducing assets through disposal of inefficient assets and idle facilities, as well as curbing investments through facility sharing. NTT DOCOMO announced that it will sell up to 6,002 of its telecommunication towers to JTOWER Inc. in March 2022. Such efforts will enable NTT DOCOMO to reduce tower maintenance and operation costs and promote the development of 5G networks.

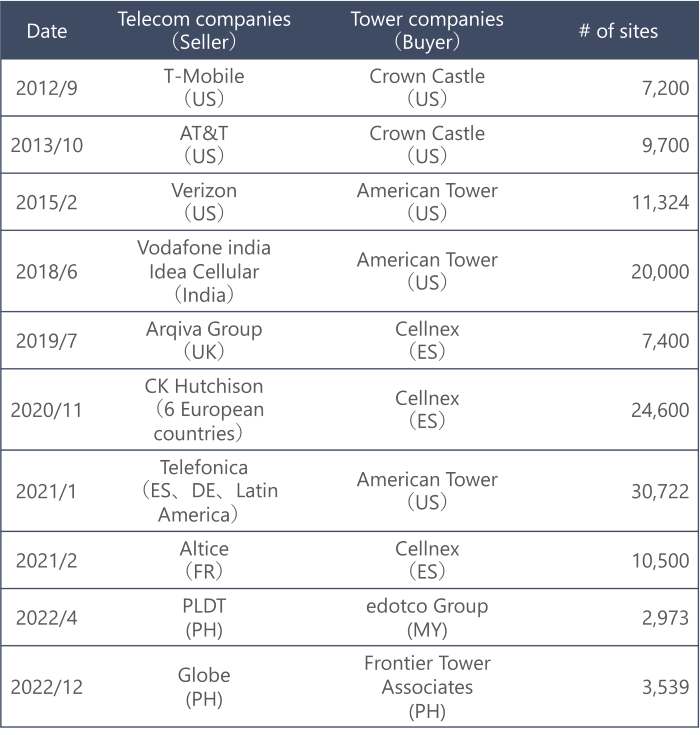

In fact, the sale of the tower asset has been major in the overseas market.

[Examples of tower deals in overseas]

Compared to the overseas market, the situation in Japan is far behind.

In telecommunications business, capital investment is unavoidable including upfront investment. However, in recent years, it can be seen that improving financial indicators by holding the asset as light as possible has become an important financial strategy to improve the valuation in the stock market.

NTT DOCOMO’s divestment of tower asset was ahead of other Japanese MNO and I believe it was a big management decision.

Buyer: Sharing provider

As a buyer, I believe it is meaningful to be owned by sharing provider, rather than the entity that conducts asset management of real estate.

Because, tower assets are indispensable for mobile phone business and account for a large portion of the investment in infrastructure. This essential facility should be owned by the sharing provider and promotes the co-tenancy with other MNO. By doing so, it is possible to increase the value and the utilization efficiency of existing assets.

Increasing utilization efficiency will reduce operating costs for seller who will use the tower ongoing basis.

In the future, JTOWER plans to consolidate towers located in the same area.

While the carve-out initiative covers only towers, I believe that the effective use of overall highly public facilities is a crucial measure that must be promoted to realize sustainable society.

New user

If tower sharing and the sharing of other facilities take place, it will be an option and will be a benefit for user since there is no need to construct new facilities.

In order to meet the expectations of user, it is necessary for sharing provider, who is the buyer, to provide information smoothly and easy-to-understand terms and conditions, as well as to prepare a scheme that contributes to the consideration of usage and uncovers potential demand.

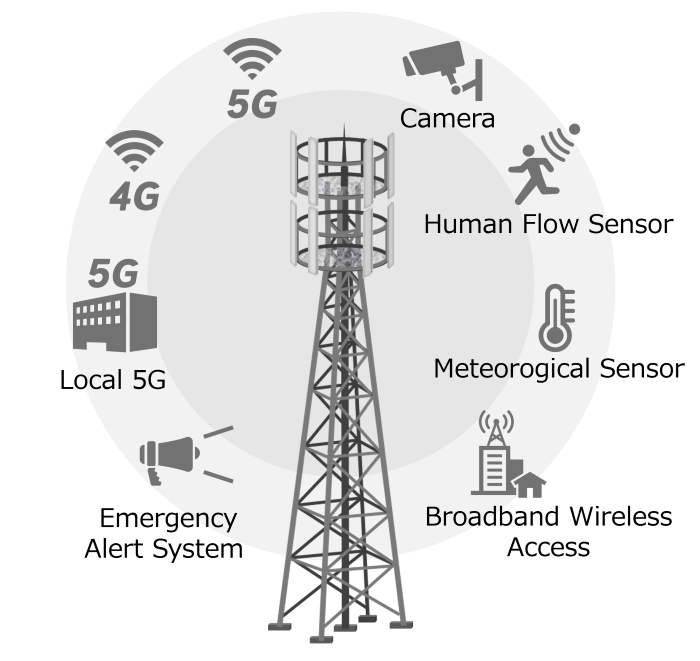

For use cases, there are the following examples:

- When new base station is installed or facility replacement is required.

MNO, Cable TV operator (such as local BWA and local 5G), LPWA and other sensor network operators.

- When it is difficult to maintain the infrastructure of existing radio equipment.

Broadcaster that is expected to improve the efficiency of broadcasting network in local areas, local governments that need to continuously maintain public radio equipment.

- When installing environmental sensors and others.

To be a game changer

Supported by the grower of the mobile phone market, the Japanese mobile business model has continued to focus on self-area-development system and the promotion of networking through generational changes such as 3G/4G/5G. However, in the current business environment, where price competition among MNO continues, capital investment is expected to become incresingly conserained.

As a result the mobile phone industly may need to consider changing its fundamental structure to develop infrastructure more efficiently. For example, assets such as tower, which is unlikely to be a differentiating factor in mobile phone services any more, will be cut into different business through carve-out. This would reduce fixed cost such as operating cost, even if the seller need to accept negative factor like their asset will be used by competitors. This approach would enable the generation of new sources of funding through carve-outs and allowing us to focus on our limited resources to new competitive areas.

In this way, I have come to the view that “carve-out can be a game changer”. By promoting carve-out we can enhance competitiveness and transform the business structure, including now we position telecommunications infrastructure.

As one of the key players to change the game, I believe that sharing provider need to demonstrate the value they can return to the user through Infra-Sharing.

※The content in the article is at the time of publication.