NEWS

- 2023.11.30

- PRESS RELEASE

JTOWER decided to enter into the financing contract for the additional acquisition of up to 1,552 telecommunications towers from NTT DOCOMO – Completed the financing of up to 16.8 billion yen to acquire telecommunications towers –

JTOWER Inc. (“JTOWER”) is pleased to announce that the company has decided to enter into the financing contract for the financing required for the additional acquisition of up to 1,552 towers from NTT DOCOMO, INC. (“DOCOMO”).

By entering into the financing contract, JTOWER expects to be able to secure the funds necessary for additional acquisition from DOCOMO. Going forward, the company will start the transfer from the tower where the condition has been met and will accelerate the attraction of new tenant, including other mobile network operators.

JTOWER has entered into the master transaction agreement to acquire 6,002 towers from DOCOMO in March 2022. In addition, the company concluded the master transaction agreement to acquire 71 towers from NTT West in July 2021 and 136 towers from NTT East in March 2022. The transfer of these 6,209 towers is proceeding smoothly and as of the end of September 2023, the transfer of 4,062 towers has been completed and the sales activities to attract mobile network operators have begun.

With the additional acquisition, JTOWER will acquire a total of approximately 7,700 towers. By expanding the coverage areas, the company will promote further utilization of Infra-Sharing.

Infra-Sharing using existing telecommunications towers leads to the effective use of infrastructure and is an effective measure to reduce environmental impact. JTOWER will contribute to both the efficient development of networking infrastructures such as 5G and the realization of a sustainable society by promoting outdoor tower sharing based on the vision of “Infra-Sharing Services from Japan Lead the World”.

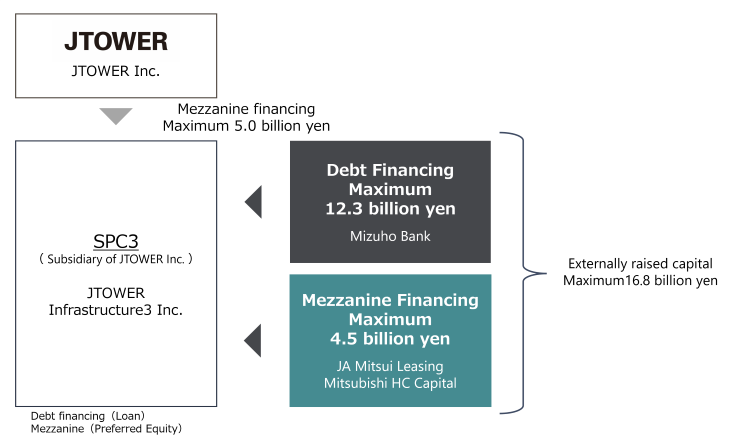

[Outline of the financing]

The total amount of the externally raised capital for the financing is approximately 16.8 billion yen and the financing consists of loans from Mizuho Bank (debt financing) and preferred equity from JA Mitsui Leasing and Mitsubishi HC Capital (mezzanine financing). Both financings are for the purpose of raising funds in JTOWER Infrastructure3 Inc., the SPC (special-purpose company) established in September 2023 as a subsidiary of JTOWER. In addition, JTOWER plans to make a preferred investment of up to 5 billion yen for the subsidiary.

[Financing structure]

[Outline of JTOWER Infrastructure3 Inc.]

(1)Name

JTOWER Infrastructure3 Inc.

(2)Head office address

2-2-3, Minamiaoyama, Minato-ku, Tokyo

(3)Name and role ofrepresentative

The representative partner:JTOWER Infrastructure Holdings3 Inc. (the consolidated subsidiary of JTOWER)

Executive officer Atsushi Tanaka

(4)Business Profile

Telecommunications Infra-Sharing business

(5)Capital

0.1 million yen

(6)Date Established

September 26, 2023

(7)Major shareholders and their shareholding ratio

Owned 100% by JTOWER Infrastructure Holdings3 Inc.